Rivile ERP

Enterprise Resource Planning and Accounting System

The system is designed for the Lithuanian market and is tailored for trade (retail, wholesale, e-commerce), accounting, services, manufacturing and many other areas. Our many years of experience and the latest technologies ensure the highest quality.

Rivile GAMA

Accounting and Business management system

Proven in a wide range of applications, used for accounting/business management in almost every third company.

Solutions for your business

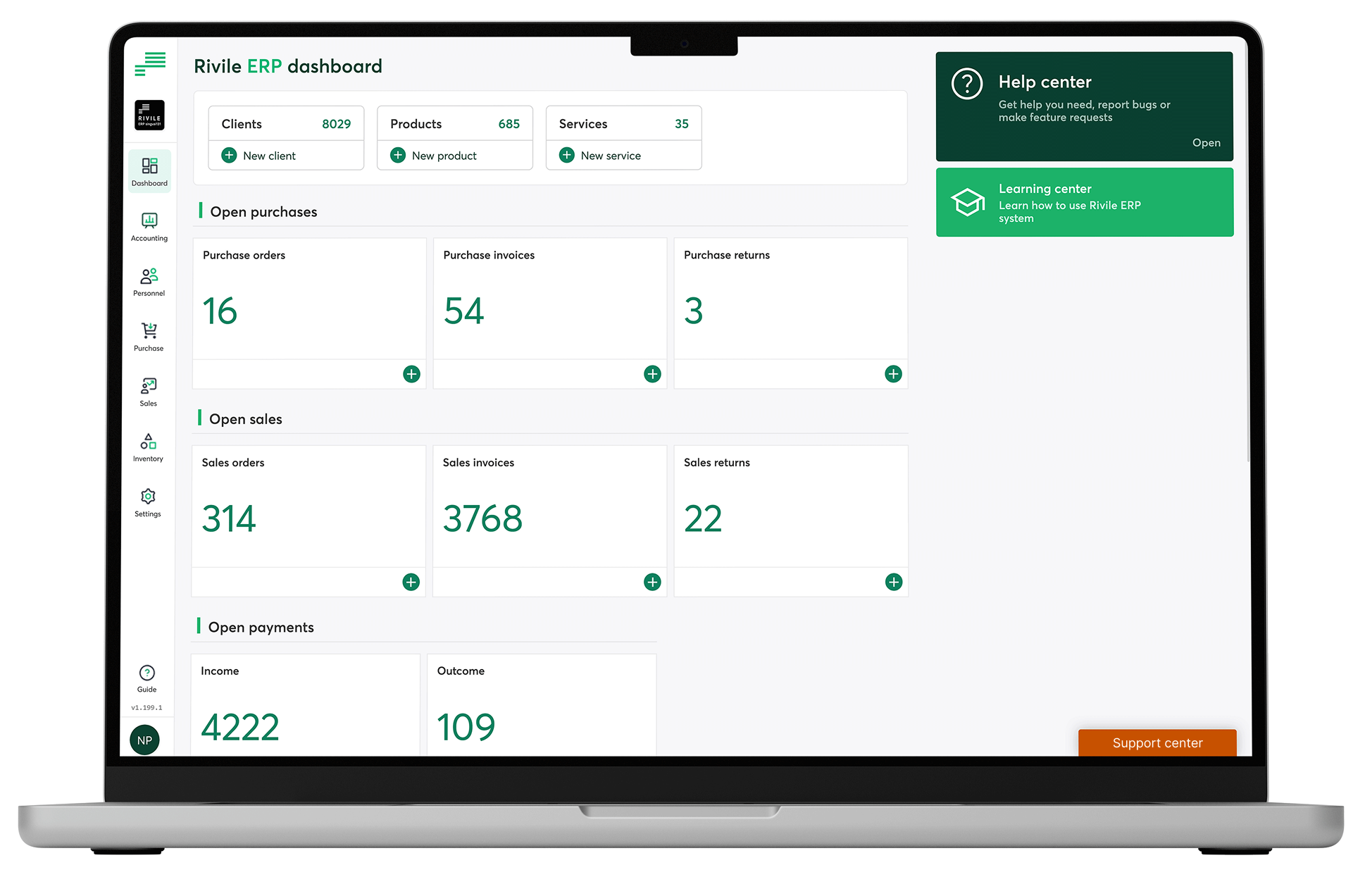

Rivile ERP

Rivile ERP is a cloud-based business management and accounting system that integrates all core business and financial processes

.png)

Automated HR and payroll processes in the cloud for large and small organisations, accessible from anywhere and ready for adoption in less than 30 minutes

Allows you to earn more with good discount system and satisfied employees

Rivile GAMA

Trusted across diverse industries, the software is used by nearly one-third of all companies in Lithuania for accounting and business management

Rivile GAMA extension modules (for web, mobile, and integrations)

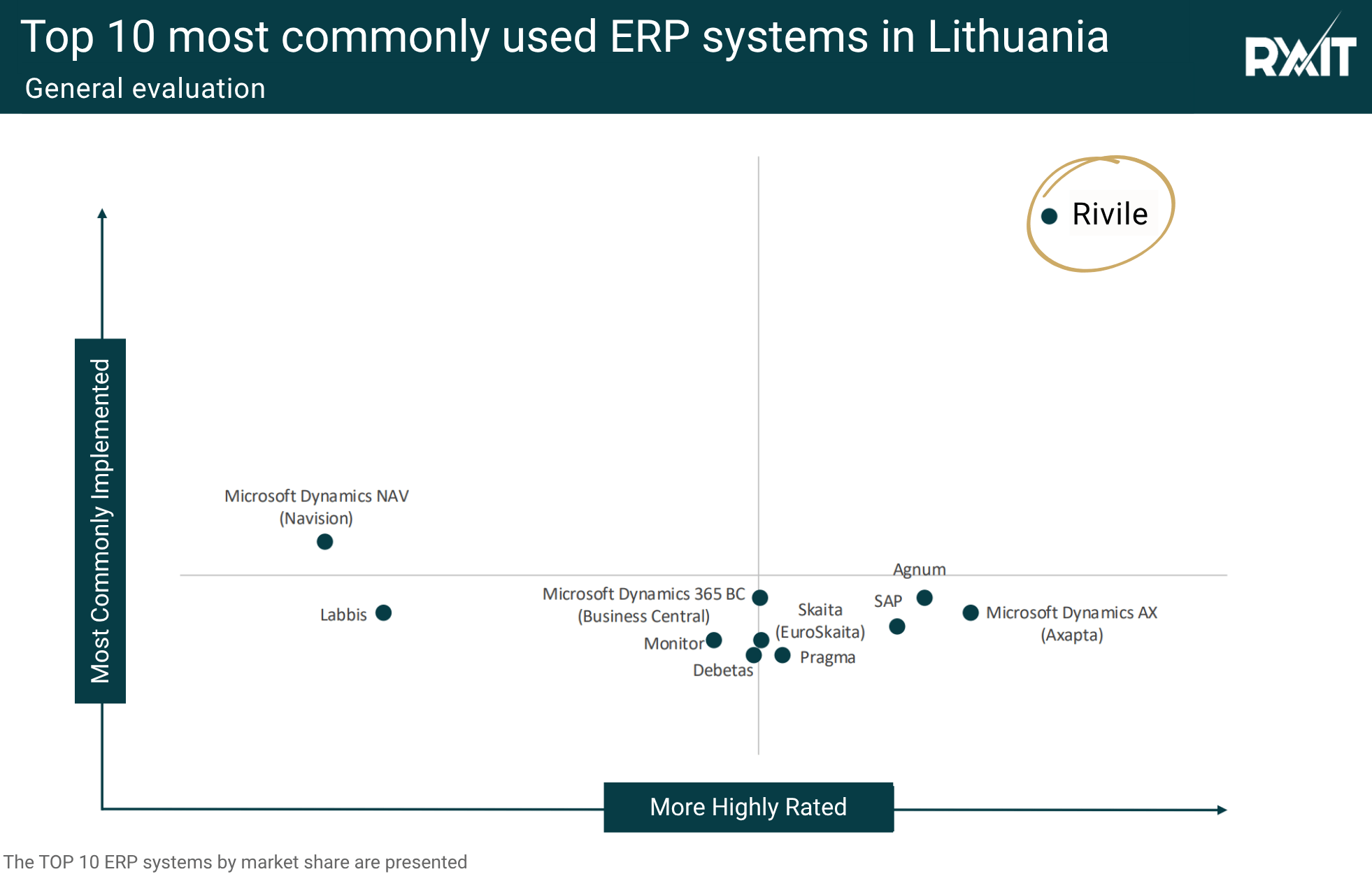

Rivile – Lithuania’s Leading Business Management System

According to the 2025 study "Usage of Financial Accounting and Business Management Systems in Lithuanian Companies", conducted by “RAIT Group" and "Informacinės Konsultacijos", Rivile is the most frequently implemented and highest-rated business management system in Lithuania.

It stands out clearly among the top 10 systems in terms of implementation frequency and user evaluations. This is a significant recognition that affirms Rivile’s leadership in the market.

Testimonials

Join us if you're looking for tailored solutions, extensive standard functionality, simple and intuitive navigation, fast implementation, prompt response to inquiries, and professional support

.png)

.png)